- Sports Business Playbook

- Posts

- All That Glitters is (not) Gold

All That Glitters is (not) Gold

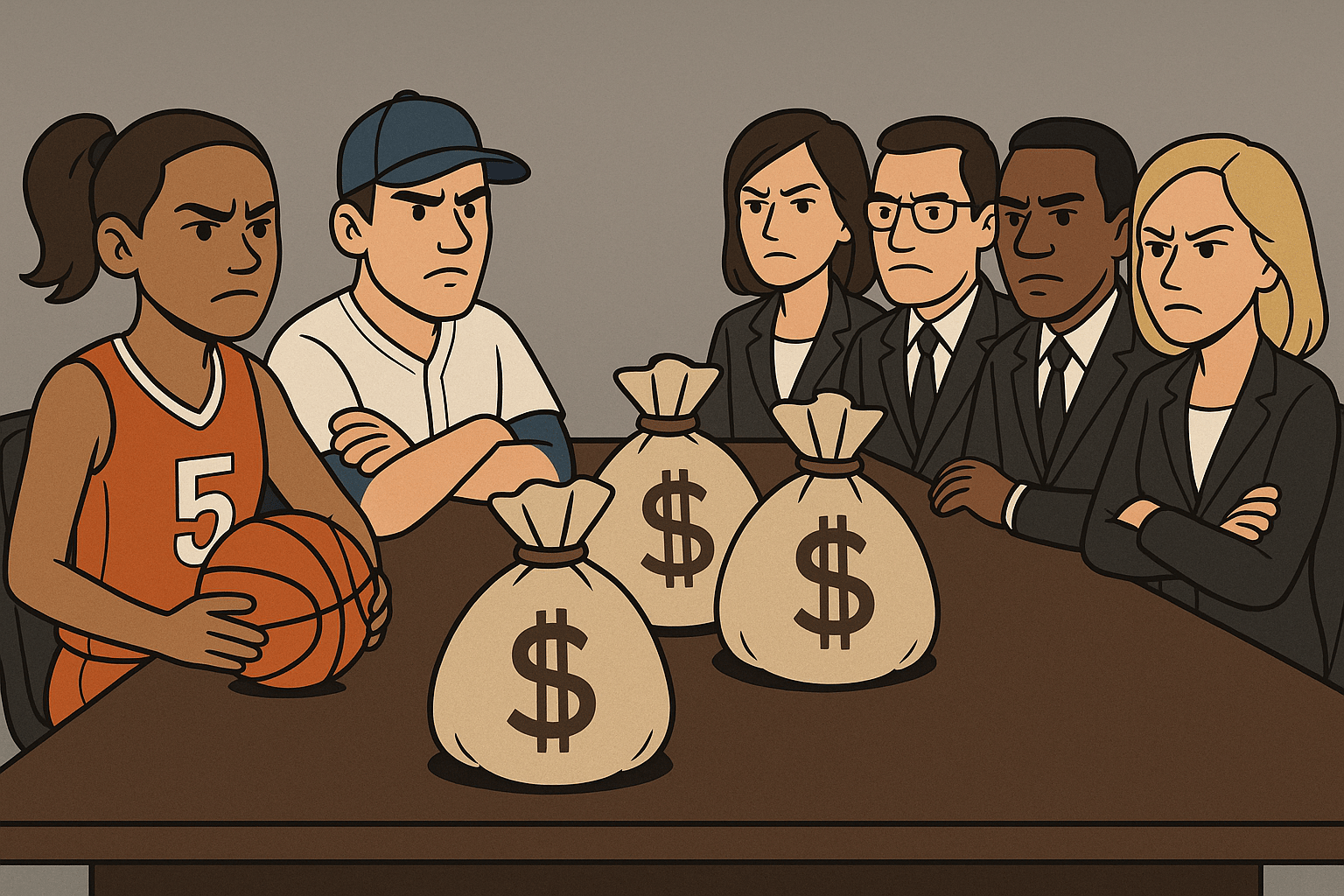

It's All-Star week for the MLB and the WNBA, and both have been enjoying exponential success the last few years. The problem? Potential lockouts in both leagues.

Forwarded this newsletter by someone in your network and want to receive it yourself? Subscribe here

Good Thursday Morning. Here’s the rundown of this week’s Sports Business Playbook:

📰 This Week’s Topic: While strange bedfellows at first glance, MLB and the WNBA are running somewhat parallel paths to each other: riding a wave of enthusiasm and business success into their All-Star games, yet they both run the risk of derailing it with upcoming labor negotiations

🍸️ Impress Your Friends at Cocktail Party: Want to show off your sports knowledge in a public setting but don’t have time to read the deep dive? Hit the “Impress Your Friends at Cocktail Party” section at the bottom for a CliffsNotes of this week’s topic

🤯 “Whoa of the Week”: Super Bowl ad price increases, and the top 100 most valuable franchises in the world, by sport

💪 Weekly Reminders that Sports are Awesome: A few great scenes from MLB’s All-Star Game in Atlanta.

Hey team,

Two leagues garnering some of the most hype right now for their business growth, MLB and the WNBA, are looking great on paper as they hit the halfway point of their season.

Both leagues have seen significant growth in their businesses the last few years, and there is a ton of “buzz” around both as they have their respective All-Star Games this week — MLB just celebrated its midsummer classic in Atlanta, GA in front of sellout crowds, and the W is taking over Indy this weekend for its ASG.

Yet unlike that earworm Smash Mouth song, all that glitters is not gold.

The two leagues are gearing up for what are expected to be contentious CBA negotiations, and if things go sideways, we could see them both enter a lockout in the next 12-18 months that jeopardizes part or even all of the season.

In this week’s SBP, we’re looking at two sports that are not often compared, yet are on similar upward trajectories that could hit a brick wall that brings them back to earth.

The Good

Image: CBC

In addition to a strong cast of stars, both well known and upcoming, MLB’s resurgence is a true case study in listening to your customers and finding ways to make change that improve the experience.

As I wrote two years ago, the league implemented three key rule changes for the 2023 season that have completely changed how the game is played:

Pitcher and batter clock to shorten the games

Banning defensive shifts to increase potential hits

Increasing the size of the bases to shorten the distance on the base paths and create more action (i.e., close plays, steals, first-to-thirds, etc.)

These changes had an immediate impact and led to a renaissance for the U.S.’s oldest sport, with attendance up 6-8% YoY in 2023 and the viewership jumped 26% YoY, and 2024 was equally as strong (highest cumulative attendance in seven years — 71.34 million).

Based upon early indicators, the 2025 season is shaping up to see more growth:

The league is tracking up 2% YoY in attendance even with two teams, the Athletics and the Rays, playing in minor league ballparks.

Through the beginning of June, the major TV partners are seeing strong viewership:

Fox: 1.84m (10% YoY)

TBS/Warner Bros. Discovery: 16% YoY

ESPN: 1.74m per game (22% YoY)

Image: ESPN

Turning to the W, while not at the same raw numbers, the growth is even more outsized.

After an excellent 2024 season that saw new records in viewership and overall attendance up 47%, the league is on pace attendance-wise through 140 games (11,085) to eclipse its overall average attendance record set back in 1998, the second year of the league when it only played 150 games (10,869), and grow by more than 13% YoY (2024 average attendance: 9,807).

While it’s fair to assume that these gains can be attributed to the Caitlin Clark effect, it’s not the only reason (Clark has missed 10 games due to injury and the Fever are actually down 1.7% this year).

Instead, much of it can be attributed to an expansion club — Golden State Valkyries — that has taken its home city by storm and sold out all 11 of its home games, and a perennial contender — New York Liberty — that has seen such increased demand that it’s opened up more sections in its home arena to increase its capacity from 12 to 17,000.

The good news for the W: even when one removes these two outliers, the league would still be up 2% in overall attendance over last year, good for third highest in its history.

The league has a ton of talented players that have built large online followings (Angel Reese and Paige Bueckers have 11.2 million and 6.6m social media followers, respectively), a complimentary domestic offseason league, Unrivaled, that performed well in its first season and raised the players’ profiles, and it is slated to start a new $2.2 billion media rights deal next year.

With all of this momentum, the general increased focus on women’s sports globally, and the inherent scarcity value of a small, 13-team league, team valuations have skyrocketed. The average franchise is now worth $269 million (+180% YoY) in Sportico’s latest rankings, and the league is set to expand to 18 teams by 2030 (the last three expansion teams will be paying entrance fees of $250 million each).

Lastly, in addition to the strong data points, both leagues are enjoying an intangible positive “feeling” about their respective games right now, and it self-perpetuates.

The recognition and buzz that MLB and WNBA are receiving should attract new fans and get lapsed fans to potentially to re-engage, increasing the growth curve.

The Bad

MLB Commissioner Rob Manfred (left) and MLBPA Executive Director Tony Clark (right). Image: Forbes

I had a negotiations professor at Michigan who spoke of a French term called “bricolage,” meaning to make creative and resourceful use of whatever materials may be at hand, regardless of their original purpose.

When he applied it to a negotiation, he boiled it down to: how can you convince the other side to see why growing the pie benefits you both, and then get them to buy into it.

A number of leagues and their respective unions — the NFL, NBA, and now the NHL — have embraced a form of bricolage, utilizing a relatively collaborative approach to enjoy general labor peace and significant revenue growth that benefits both sides.

MLB and the WNBA…not so much, and it’s due to fundamental challenges in the way the leagues are structured.

When looking at MLB, it faces two interconnected issues: an eroding regional sports network model that is eating away at revenue, and the lack of a salary cap that leads to higher costs. I’ve written extensively about #1, but the league’s dependence on local media revenue (often about 25% of overall revenue, while other leagues are at least 10% less) has created a lack of competitive balance because the bigger market clubs have the means to generate more revenue than the smaller market clubs.

This system of have’s and have not’s is then exacerbated by the lack of a salary cap, because the small market teams would have to pay out of pocket to compete with the bigger teams that are spending exponentially more.

Per CNBC, there are nine teams spending over $200 million on salary in 2025, and there are five spending less than $100 million. The difference between the highest spending team and the lowest has reached an all-time high — the Mets’ $323 million compared to the Marlins’ $67 million results in a record $256 million delta. Note that this also doesn’t count clubs paying the league’s luxury tax, as the Dodgers will spend a record $500+ million and the Mets will pay more than $400 million.

The league recognizes this issue and believes a cap is necessary, and some data from industry experts would support them: in the same CNBC article, the publication calculates that the average MLB team’s EBITDA is 5%, which pales in comparison to an average EBITDA of ~20% for a franchise in the NBA, NFL, and NHL.

Former president of NBA league operations and current Columbia University professor Joel Litvin summed it up well:

“The average MLB salary hasn’t kept pace with the league’s increase in revenue, which has grown at a rate of 4.1% per year in the past decade…Had salaries been tied to revenues (as they are in the other leagues), the players would have earned an additional $2.3 billion in salaries over that period…His calculations conclude players’ salaries have increased 3% per year over the past ten years.”

This coincides with Commissioner Rob Manfred’s statement earlier this week that the top 10% of MLB players are earning nearly 75% of the total player salary pool.

The problem is that the MLB Players’ Association does not subscribe to this line of thinking, and it’s by far the MLBPA’s biggest leverage point that they’ve held onto for decades. Here’s MLBPA executive Tony Clark:

“A cap is not about a partnership. A cap is not about growing the game…A cap is about franchise values and profits. …This is not about competitive balance. This is institutionalized collusion.”

The MLBPA also correctly calls out teams that intentionally don’t spend much and aren’t competitive, but reap the benefits of revenue sharing from the national level and the big clubs. In addition to the aforementioned Marlins, the A’s, Rockies, and Pirates are regular culprits of this.

It is hard to see the MLBPA moving off of this point and potentially limiting its contract sizes at a time where the league has such sunny numbers to report.

Image: Sports Agent Blog

And if you thought this was convoluted, wait until you hear about the W’s league structure.

I wrote about the pending labor dispute last fall, and here’s a refresher.

Most labor negotiations in sports are two-sided: the owners, represented by the commissioner, are negotiating with the players’ union.

There are several key items that are negotiated as a part of these agreements, but the two main deal points at the center of every CBA are the revenue split between the owners and players, and how the salary cap is calculated

These points are interconnected, and every league uses the revenue share and salary cap to implement agreed upon player salary bands for specific situations — i.e., a league minimum, a “rookie pay scale” — that enable fairness, repeatability, and stability across the league.

As an example, NBA players receive 51% of all “basketball-related income” under their current CBA. This correlates to the salary cap and the amount the players are able to make, and it makes sense given there are only two interested parties.

This is different in the W, which has other groups involved. The reported ownership stakes are:

NBA: 42%

WNBA: 42%

Equity holders from a 2022 fundraise: 16%

The confusing part is that there are investors who fit into two, or sometimes even all three, buckets, meaning that who truly owns what is a bit of a black box.

As an example, sources told the New York Post that the NBA owns nearly 75% of the W if you count all of the various stakes held by the league or its owners. This gets even more complex now that the league has introduced five new expansion teams that are playing/will begin play before the end of the decade.

Regardless, this structure means that the W is splitting the revenue pie several ways before hitting the clubs and players’ bank accounts.

Bloomberg has an in-depth piece on how they get to the calculation, but here’s the key takeaway: salaries as a total share of revenue in the W were just 9.3% in 2022, down from 11.1% in 2019. In practice, this means that under the current CBA, the max WNBA salary is $252k.

From the players’ perspective, this is unacceptable. They’re seeing the league’s exponential growth and notable upticks in revenue/expansion fees, and they have been vocal about wanting a larger piece of the pie (the league’s first offer was a “slap in the face,” they’re being “ignored,” and the “meetings are going to be spicy.”)

On the other side, the WNBA league office is having to reconcile not only this complex cap table but also the fact that the league has still not translated its hype and on-paper success in valuation growth to tangible dollars.

The W’s current CBA was signed during a time of economic turmoil (2020) and while this agreement included a number of improvements — salaries increased 100%, total cash compensation increased to $500k, and additional benefits included like basic hotel accommodations, women’s health care and maternity benefits.

While it may feel outdated now due to the increased attention, it worked at the time and the league still has not fully converted value/potential to dollars.

Teams are averaging $22 million in revenue, most are still not profitable, and the valuation to revenue multiples have risen to the highest in North American sports at 12x, showing the frothiness of the league.

Bankers and investors traditionally use revenue multiples to value sports teams, and the @WNBA has moved to the top of the table among major sports leagues at 12 times 2024 revenue

— Lev Akabas (@LevAkabas)

3:29 PM • Jun 24, 2025

It’s fair for players and fans to be upset about the hesitancy on better revenue sharing and increased salaries and chalk it up to crying poor when it’s convenient, but the reality is that the league is much more sizzle than steak right now on the balance sheet.

That’s a hard pill to swallow when so much of the CBA negotiation is based in hard data and conservative projections, and it means both sides are likely going to have to compromise to get what they want.

The Potentially Ugly

It goes without saying that biggest losers of labor disputes are the fans.

In addition, lockouts in these two leagues have an additional con — they could jeopardize the momentum both have built.

Attention is everything in today’s cultural narrative, and if you fall off the radar and the public moves on, it can be hard to reclaim that spot. This is particularly true for an older league trying to re-insert itself into the zeitgeist, or a younger league trying to solidify its foothold in the conversation.

It will be interesting to see how the two leagues act similarly/differently as they enter into the negotiations.

A lockout would create a challenge for MLB to regain its momentum, but it would be devastating for the WNBA, in my opinion.

But, while I do think the W has more to lose in terms of recapturing attention in a prolonged labor dispute, the players have more leverage than MLB. There are overseas options (or even an extension of Unrivaled’s season 👀 ) available, which means they could wait the owners out.

MLB is in a more precarious position upfront given the hard stances on salary caps and mismatched incentives between the big and small clubs. But even though the MLBPA specifically has a player’s fund in the case of a lockout, the two sides usually recognize the enormity of the lost revenue and end up kicking the can down the road on the major issues in order to get games restarted. I’m expecting something similar should a lockout happen.

Lastly, while things don’t look good now, there is always hope for both leagues.

Much of the current tough talk before negotiations heat up could be chalked up to gamesmanship and saber rattling, and the owners and unions can recognize the opportunity in front of them to grow the pie by working together instead of fighting for what’s currently on the table.

Here’s hoping both groups’ better angels win out and we’re able to see the leagues continue their revitalizations.

🍸️ Impress Your Friends at a Cocktail Party

Want to show off your sports knowledge in a public setting but don’t have time to read the deep dive? This section is the CliffsNotes of this week’s topic

Opener: While not often compared to each other, MLB and the WNBA are running very similar paths right now. Both have experienced significant growth the past few years that has captured national attention, and both are also staring down potential labor disputes over the next 12-18 months due to fundamental structural issues that could derail this momentum

Shot: On the positive side, MLB has seen consistent growth the last three years thanks to a stable of stars and rule changes in 2023 that helped speed the game up and increase in action. The W is riding a crop of young, socially savvy stars and increased awareness around women’s sports in general to record attendance/viewership numbers and 180% year-over-year growth in team valuations

Shot: MLB’s issues stem from an eroding regional sports network media model that creates revenue disparities, and therefore competitive imbalance, between the big and small market clubs. This is exacerbated by the lack of a salary cap in the league. MLB’s owners want to institute a salary cap to try to rectify this (and there is some data that this would actually benefit players), but the players’ association is vehemently opposed to it.

Shot: The W’s has a complex ownership structure — instead of just owners and players’ union like most leagues, there are also outside investors and the NBA. This competing interests make it even harder to settle disputes like the upcoming fight over revenue sharing because the players feel they should be compensated more but the pie is often carved up significantly before it ever gets to them.

Chaser: If a new CBA cannot be reached, the leagues would deal with a work stoppage, or lockout. This is on the whole bad for both groups because it could spoil the buzz around the two leagues and hurt their top/bottom lines, but it would be particularly devastating for the W in my opinion given that they are still a nascent league trying to find their footing. Here’s hoping both can resolve their issues.

🤯 “Whoa” of the Week

Insane, mind-blowing things constantly happen in the sports business world. Here was my favorite of the past week.

Super Bowl ads are already increasing in price due to demand

NBCUniversal’s Super Bowl LX ads are already climbing to $8M for a 30-second spot, due to demand.

The company hit its cap during upfronts and is now seeking $8M matches across sports like the NBA and 2026 Winter Olympics.

Via @Adweek

— Sports Business Journal (@SBJ)

7:30 PM • Jul 14, 2025

The world’s most valuable sports franchises, by sport

The world's top 100 most valuable sports teams includes...

• all 32 NFL teams 🏈

• all 30 NBA teams 🏀

• 15 MLB teams ⚾️

• 10 soccer clubs ⚽️

• 8 NHL teams 🏒

• 5 F1 franchises 🏎️— Lev Akabas (@LevAkabas)

4:26 PM • Jul 14, 2025

💪 Weekly Reminder that Sports are Awesome

This newsletter is, of course, mostly centered on the business side of sports and the things that happen off the field. That being said, it’s important to remember why we fell in love with sports in the first place, though.

This section is meant to highlight the amazing things that happened in sports this week that serve as that reminder.

Fun hearing Kershaw mic’d up while pitching in what is likely his last All-Star Game

Clayton Kershaw mic'd up is legendary 😂

— FOX Sports: MLB (@MLBONFOX)

1:48 AM • Jul 16, 2025

A fitting tribute in Atlanta to one of the greatest ever

This Hank Aaron tribute is one of the coolest things I’ve ever seen at a professional sporting event. Wow.

— Jared Carrabis (@Jared_Carrabis)

2:14 AM • Jul 16, 2025

In the event of a tie after nine innings, the MLB All-Star Game apparently now goes a home run derby. Who knew! Very fun ending to a great week in Atlanta for MLB.

KYLE SCHWARBER GIVES THE NL THE LEAD WITH THREE BOMBS

— Jomboy Media (@JomboyMedia)

3:50 AM • Jul 16, 2025

Thanks for reading! Let me know what feedback you have.

Also, if you enjoyed this breakdown, please consider sharing it with your friends and network by clicking the social media icons at the top of the newsletter.

Until next time, sports fans!

-Alex